Despite the slight decrease in April’s results (from 18.97 to 18.24 per cent), the ‘Food and Non-alcoholic Drinks’ inflation rates remain stubbornly high and they are still around the highest ones in over 45 years. Moreover, although the ‘All items’ inflation in April decreased somewhat for the March rate (from 10.1 per cent to 8.7 per cent), the figure in May has remained at April’s level. This is still four times higher than the Bank of England (BoE) target of 2 per cent, promising another increase in the interest rate.

The inflation results have been accompanied by several discussions trying to palliate the situation and understand why food prices are going up despite the increases in the interest rate by the BoE. Amongst the first ones, there have been ideas of suggesting retailers introduce a voluntary price cap system on basic foods such as milk and bread. A proposal that has been categorically rejected by the industry.

Within the second proposal understanding the reasons behind the persistent food inflation, the Competition & Markets Authority launched an inquiry into the competitiveness of UK supermarkets amidst claims that they or their suppliers have been profiteering, increasing their prices under the explanation of facing higher costs.

The purpose of this note is to provide a more detailed look at the inflation figures, focusing on the situation of food prices, and in particular, those of fruit and vegetable ones due to their association with topics such as Brexit, farmers’ complaints about their returns, and nutrition.

A quick view of the distribution of the entire budget

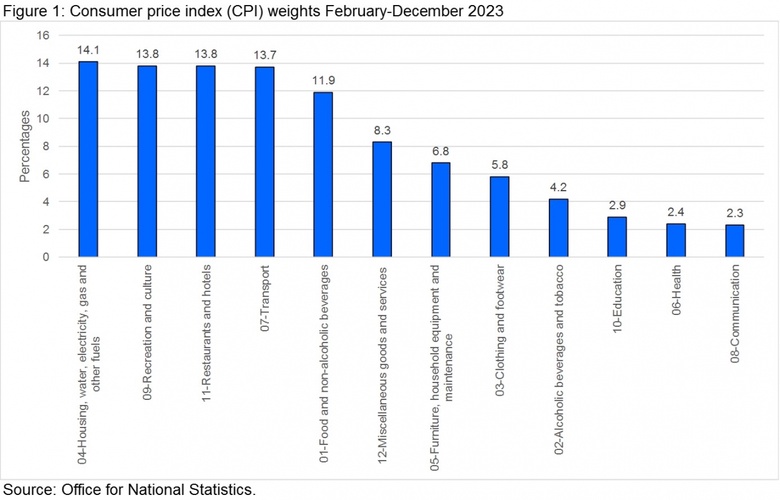

As shown in Figure 1, whilst on average, food and non-alcoholic beverages are not one of the four top categories, it is quite close (11.9 per cent). Moreover, one should consider that those weights (i.e., the share of the category on the total expenditure) are for the average budget. For the poorest households (i.e., the lowest gross income decile) in the financial year ending in 2021, food and non-alcoholic beverages represented 18.1 percent

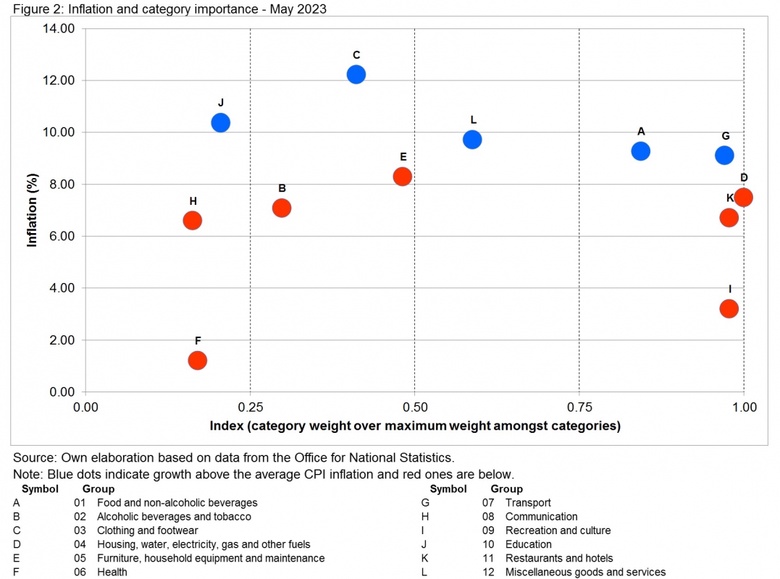

Figure 2 combines the most recent annual inflation figures (May 2023), shown on the vertical axis, with an index -shown on the horizontal axis- where the most important category (in terms of average household expenditure) takes the value of 1. Blue dots indicate categories with inflation rates above the average, and red dots indicate the opposite.

The figure shows that the food and non-alcoholic beverage category (letter A in the figure) is contributing to increasing inflation as it has relatively high importance, and its inflation rate is above the CPI average rate. Note that the red dots, although they are below the CPI average inflation, all are showing price increases.

Focusing on the food category

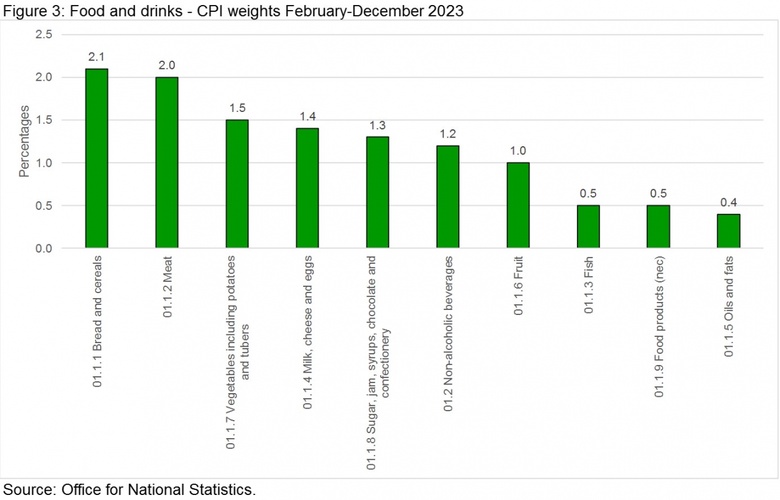

When one considers the food and non-alcoholic drinks as shown in Figure 3, which breaks down the 11.9 per cent observed in Figure 1, bread and meat are the top categories, followed by vegetables (including potatoes and tubers). Bread and cereals and dairy, both groups mentioned in the discussions are among the top groups.

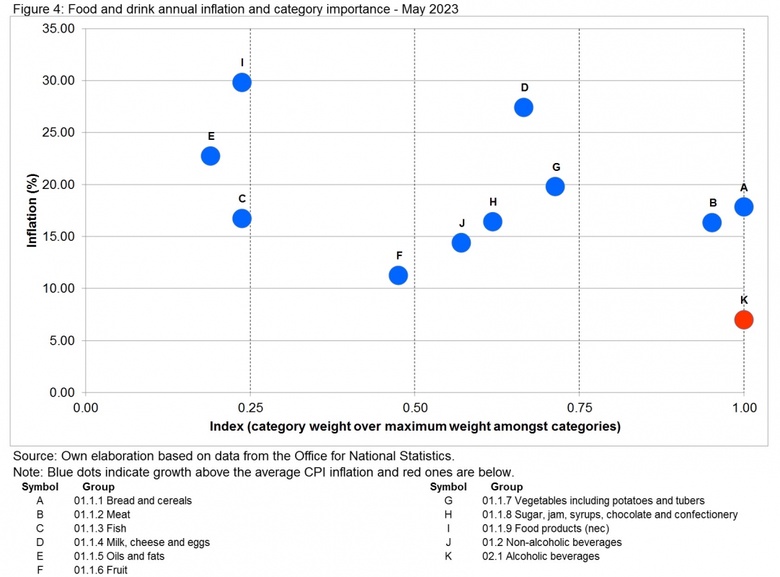

Figure 4 mimics Figure 2 but is applied to the food and non-alcoholic drinks categories (adding also the alcoholic drinks category). An interesting feature is that except for the prices of alcoholic drinks, which are growing but at a lower rate than the CPI inflation, all the food and drink categories are above the inflation (all are blue).

As each one of the food and drink categories represents one or more markets, it means that the situation is more worrisome than when one only considers the aggregated food and drink category. This is because although there might be common factors affecting all those markets such as the impact of higher energy costs, each one of the markets is supplied by many different supply chains, each one with its particularities (e.g., the oils and fats category is affected by the drought faced by olive producers in Spain and by the Ukraine-Russia conflict influencing the price of sunflower oil). Note also that the lowest inflation is related to the Fruit category (letter F in the figure) with an annual inflation of 11.2 per cent.

An eye on the fruit and vegetable categories

Because of their importance for nutrition, agriculture, the discussions regarding Brexit, and also their scarcity showed in supermarkets in February 2023, it is useful to have a look at the evolution of fruit and vegetable prices.

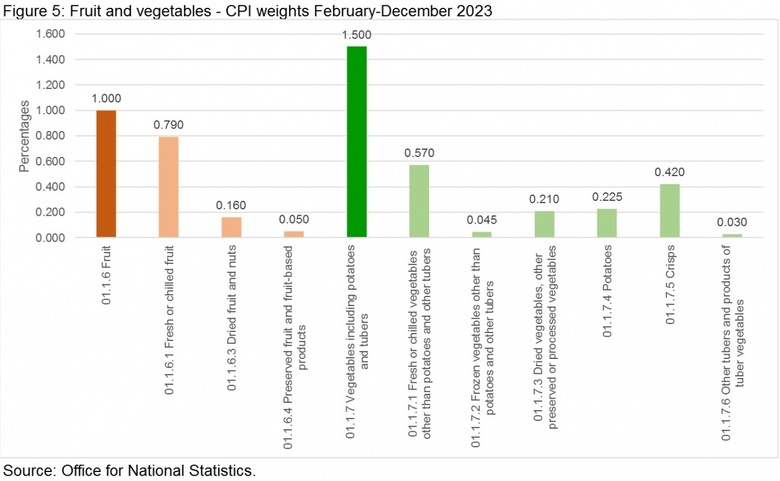

Figure 5 shows the CPI weights on the average expenditure for fruit and vegetables. Darker orange and green represent the total weight for the fruit and vegetable categories, whilst lighter colours show their composition. This is useful to understand how we allocate our money within both categories. In the case of fruits, most of it is allocated to fresh fruit (0.79 per cent out of the 1 per cent for the entire category). That is not the case in the case of vegetables where fresh vegetables are almost hand in hand with crisps and potato’s share is only a bit lower than that of dried vegetables.

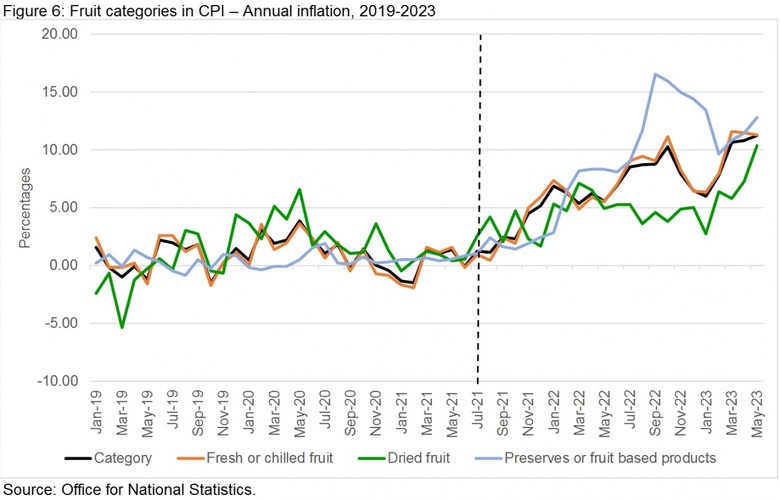

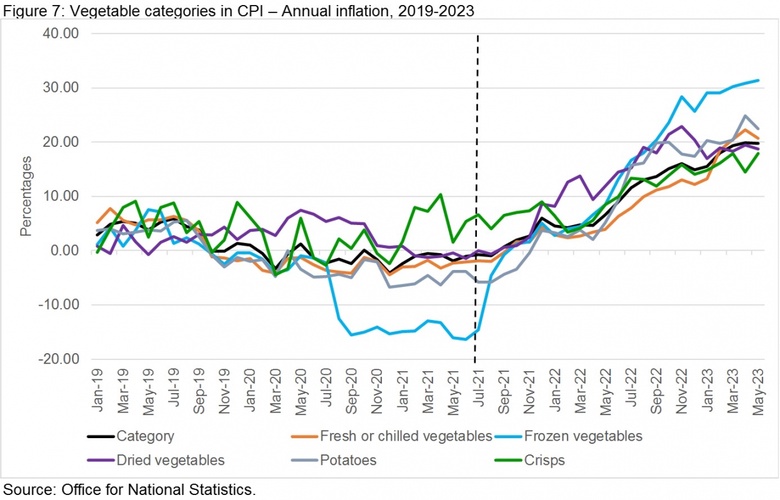

Figures 6 and 7 show the evolution of the annual inflation for fruit and vegetable categories. Whilst the growth is not steady, all the series have an increasing trend since mid-2021 (marked with a dotted line in the figure), which one can identify with the different effects of the Ukraine and Russia conflict (e.g., energy, and fertiliser prices) to domestic and imported produce.

Something to highlight in Figure 7 is the behaviour of frozen vegetables, which after a period of deflation (end of 2020 and first half of 2021) it shows that its prices are now growing faster than the vegetable category inflation.

Final thoughts

Food price inflation will not go down until the unbalances in the different food markets have disappeared. These include factors such as the situation of energy, inputs, labour constraints, logistics costs and other food supply chain disruptions that still need to go back to normality. We have explored this in an analysis of domestic food supply chains.

Regarding the suggestion of price caps to curb inflation, as proved by many of these economic experiments around the world in both developed and developing countries, as we economists have learned, price manipulation never works. In the end, it has always several unintended consequences, and someone always pays for the policy e.g., citizens, suppliers, or the government. Moreover, several supermarkets have announced to keep the prices of a basic basket of products controlled; however, it is not clear what part of the food supply chain will be squeezed to finance this, particularly when input prices both domestic and imported are still growing.

Instead, a public policy targeted to households with lower means or with fewer possibilities to look around for lower prices (e.g., the population in remote areas) and those who are struggling can be a more efficient and effective way of fighting against the living cost crisis. As the government states, they will continue supporting households through their £94bn package (according to their figures the support is worth £3,300 on average per household in 2022 and 2023). Of course, these benefits are partly offset by the increase in the interest rate, which has the purpose of contracting the aggregate demand (i.e., decreasing households purchasing power) to lower inflation.

Cesar Revoredo-Giha is a senior economist and food marketing research team leader and professor at the Rural Economy, Environment and Society Department at Scotland’s Rural College (SRUC).

Please direct any correspondence to Prof Cesar Revoredo-Giha

Wisdom Dogbe is an applied economist and Research Fellow with The Rowett Institute of Nutrition and Health.