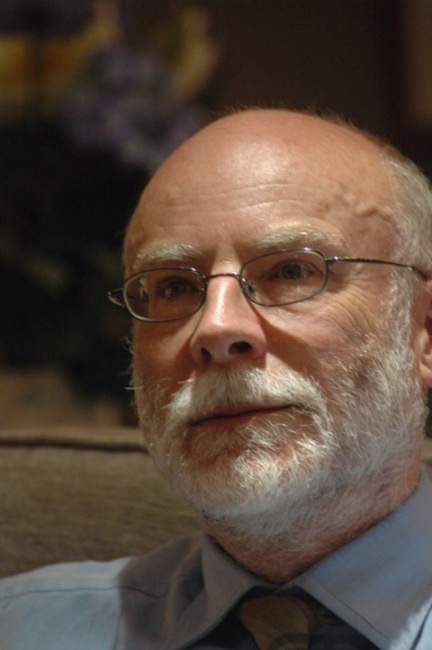

A University of Aberdeen Honorary professor has been appointed as Adviser to the Finance Committee of the Scottish Parliament on the Revenue Scotland and Tax Powers Bill.

Professor Gavin McEwen will hold the post until June 2014 and his role will be to provide expert analysis and briefings supporting the Committee as it considers the Bill and submitted evidence and as it prepares its Report on the Bill to the Scottish Government. The Bill provides for the establishment of Revenue Scotland and the administration and collection framework for taxes introduced under the devolved powers in the Scotland Act 2012. These are, initially, the Land and Buildings Transaction Tax and Scottish Landfill Tax which are expected to replace Stamp Duty Land Tax and Landfill Tax in Scotland from April 2015. As other taxes may be devolved, the provisions of the Bill must be of broad application and include, for example, a General Anti Avoidance Rule which will apply to all Scottish taxes.

Professor McEwen has been an honorary professor of taxation at the University of Aberdeen since 1994, and currently assists with the Taxation Course in Finance and Accountancy.

Professor McEwen graduated from the University of Aberdeen in 1983 with MA Hons in Mental Philosophy, before completing two further degrees at the University of Kansas and the University of Oxford.

His career includes working as HM Inspector of Taxes 1975 to 1982, tax manager and then tax partner with Coopers & Lybrand (now PwC) in Aberdeen from 1982 to 2000, tax partner with PwC in Nairobi, Kenya, from 2001 to 2007. Since 2007 he has worked part time for the Score Group plc, Peterhead, and provided international tax training in Nairobi, Dar-es-Salaam and Lagos.

Professor McEwen is now looking forward to working for the Scottish Parliament.

He says: “I am honoured to have been appointed to this position and look forward to working with the committee over the next six months. This is a unique opportunity to contribute to the foundation of a system of tax administration fit for the twenty-first century.”